I always look for alternate ways to diversify my income instead of letting my money sit in the bank. After some exploration, I found that Versa is one of the app that could help me just do that. So, in this post I will be giving an honest Versa Malaysia review about it.

Ready to Get Started?

Sign up for Versa today and join with the referral code WUZMTGGR. Make a minimum deposit of RM100, and you’ll receive an RM10 fund unit—one that will place funds in their pocket as well, since it will benefit the person who referred you! It’s a win-win situation all the way!

Versa Malaysia Review, My Thoughts

If my Versa Malaysia review is TLDR for you, my main point is to go for it. It is safe and complies to regulations. The interest rate is like 3% which is way better than a lot of banks in Malaysia itself. Popular banks like Maybank can’t even give that high.

Give it a try, use the referral code of mine, and pick on Versa Cash first. You can probe into their other investment type when you have the free time. That’s pretty much good enough.

Put in money periodically and check out their promotions from time to time to maximize the earnings that you can potentially get with this app. You also can send your referral code to your family & friends for that sweet little bonus. It’s one of those things that you can be proud to share and not be ashamed of it.

Everyone likes to make money after all. Checkout the other also popular platform, Stashaway. Discover how does Versa compare with Stashaway in another blog of mine!

What is Versa Malaysia?

Versa Malaysia is an app for digital wealth management that has become a popular choice among Malaysians like myself who are looking for low-risk, flexible investment solutions. With the mission of making finance inclusive for everyone, Versa provides its users with a variety of products both for new investors and seasoned savers alike. It’s licensed by the Securities Commission Malaysia, providing assurances of a secure and safe space for users to grow their wealth.

Versa’s core philosophy is transparency, openness, and simplicity. By offering a low minimum deposit requirement, a simple mobile app, and daily pay-out of interest, Versa has established itself as a viable replacement for fixed deposits and traditional savings accounts.

How Does Versa Work

Versa is a mobile investment and cash management platform. Therefore, you can put money into your own Versa account, and it is invested in low-risk investment products or money market funds. The website collaborates with professional fund managers and trustees such that the users’ funds are professionally and securely managed.

The process is straightforward – just follow the screen guide:

- Sign Up: Sign up in the Versa app using your personal details and go through the e-KYC (electronic Know Your Customer) process.

- Deposit Funds: Deposit money from your bank to Versa.

- Choose a Product: Invest in various Versa products, such as Versa Cash, Versa Growth, or Versa Retirement.

- Earn Returns: Your money starts earning interest each day, and it is added to your account.

- Withdraw Anytime: Enjoy the convenience of withdrawing your funds at any time, with same-day or next-day processing in the majority of instances.

The Versa appeal is in its unique blend of safety, liquidity, and competitiveness of return, which makes it extremely appealing to emergency funds, short-term savings, and even long-term wealth accumulation.

Core Features of Versa Malaysia

Versa Cash: Low-Risk Cash Management

Versa Cash is the gold product, this is literally one of the main takeaway of my Versa Malaysia review. It is suitable for those customers who would like to earn higher returns than a conventional savings account but are not willing to make high-risk investments. Money market funds in which funds in Versa Cash are invested typically consist of short-term government obligation and high-grade corporate bonds.

Core Highlights

- Interest Daily Calculation: Calculation and crediting of interest daily to see your money increase in front of your eyes.

- No Lock-In Period: Withdrawal anytime with no charges.

- Low Minimum Deposit: Start as low as RM1, making it accessible to all Malaysians.

Versa Growth: Saving for Long-Term Wealth

For those investors who need enhanced returns and can bear some risk, Versa Growth offers exposure to a mix of equities and bonds. The investment is suitable for investors with a long-term horizon and wish to build wealth over the years.

Major Points:

- Diversified Portfolio: Investment in the domestic as well as offshore markets.

- Professional Management: Competent asset managers oversee the funds.

- Flexible Contributions: Invest or withdraw money as your money changes.

Versa Retirement: Saving for Your Retirement

Versa Retirement is a strategy aimed at people saving to retire. It is a combination of steady growth and capital preservation, hence suitable for retirement saving.

Key Highlights:

- Retirement-Oriented Asset Allocation: Get optimal balance between safety and growth.

- Tax Benefits: Tax benefits for retirement savings (subject to current tax legislation).

- Goal Tracking: Set and monitor your retirement goals in the app.

- Easy-to-Use App and Interface

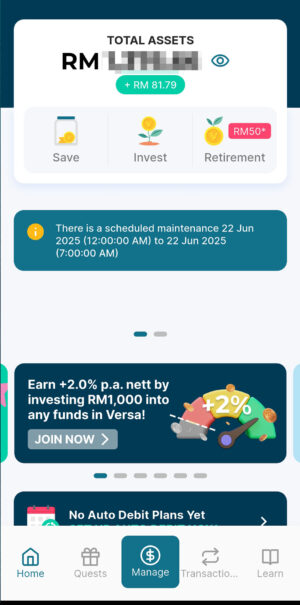

The Versa mobile app is designed to be easy to use. The straightforward interface allows users to:

- Monitor account balance and return.

- Make deposits and withdrawals a breeze.

- Monitor investment performance with in-depth analytics.

- Get access to educational resources and customer support.

Accessibility and Minimum Deposit Requirements

Amongst Versa’s greatest strengths is the fact that it is so accessible. With a minimum deposit of only RM1 for Versa Cash, the platform welcomes all to invest no matter how much one has.

Returns and Performance

Current Interest Rates and Returns

In 2025, Versa Cash provides returns of between 3.0% to 3.5% on an annualized basis, depending on the current market conditions. This is super good news to me! Versa Growth and Versa Retirement products provide returns that change with market performance levels, with historic averages at 5% to 8% per annum.

Returns are unpredictable and can move with changes in interest rates and market conditions. However, Versa’s investment in low-risk securities for its cash management products provides some stability that is not realized with riskier investments.

How Returns Are Different from Fixed Deposits and Other Sites

Versa’s returns consistently outpace returns on traditional savings accounts, which offer less than 2% return annually. Versa Cash is even competitive against fixed deposits, let alone having the added convenience of instant withdrawal.

Versa is competitive against other digital cash management platforms like KDI Save, StashAway Simple, and Touch ‘n Go GO+ compared to equivalent or better digital cash management platforms. It offers better or equivalent returns, lower minimum initial deposit, and a simple-to-use app experience.

Versa Malaysia vs Maybank Savings Account: Interest Rate Comparison

Now, let’s get into one of the most important highlight of this Versa Malaysia review. It offers a cash management product with annualized returns typically ranging from 3.0% to 3.5% per annum (accurate at the point of writing this review) , paid every day and redeemable at any time. Rates are floating and can track the market but are always above normal bank saving rates.

Product | Interest Rate (% p.a.) | Notes |

Versa Malaysia (Cash) | ~3.0% – 3.5% | Daily interest, no lock-in, subject to market |

Maybank Savings Account | 0.05% – 0.60% | Tiered by balance: |

| 0.05% | – <RM1,000 | |

| 0.20%–0.30% | – RM1,000–RM100,000 | |

| 0.60% | – >RM100,000 |

Maybank Savings Account interest is considerably lower, ranging between 0.05% yearly for balances of less than RM1,000, to a maximum of 0.60% yearly for balances of over RM100,000. Most regular savers will find themselves with rates of between 0.20% and 0.30% yearly for balances of less than RM100,000.

Just from this alone, it’s good enough for me to put my investment into Versa.

Daily Interest and Withdrawal Experience

Versa interest builds up each day and is credited to your account to help compound growth. Fast withdrawals are made, often within one business day, so Versa is a practical option for emergency funds or short-term savings.

Fee Structure

Here in this section of my Versa Malaysia review, I’m gonna dig into the charges. Don’t worry, it’s super low that it’s well worth it. They’re quite upfront and transparent about it too.

Management and Trustee Fees Explained

Versa has an evident fee structure. For Versa Cash, the management fee is normally 0.30% per year, trustee fees are minimal (typically below 0.05% per year). Fees are deducted directly from the fund’s returns, and net returns show in users’ accounts.

How Fees Are Calculated and Deducted

Fees are determined as a percentage of assets being managed and are charged before interest is credited to customers. This means the rates displayed on the app are net of fees, providing transparency and clarity.

Transparency of Fee Structure

Versa is upfront about all charges, with explicit explanations included in the application and on their website. There are no hidden fees, and users pay no withdrawal or deposit fee, so Versa is a low-cost way of managing cash.

Pros and Cons of Versa Malaysia

Advantages of Utilizing Versa

- High Liquidity: Withdraw funds anytime without charges.

- Competitive Returns: Greater than most fixed deposits and some savings accounts.

- Low Entry Barrier: Start with as little as RM1.

- Easy-to-Use App: Convenient interface and seamless account management.

- Regulated Platform: Registered with the Securities Commission Malaysia.

- Daily Interest: See your money increase daily.

Possible Drawbacks and Constraints

- No Guaranteed Returns: Returns will be determined by market conditions.

- Limited Investment Choices: Primarily low-risk, cash management products-oriented.

- App-Only Access: No desktop web-based platform.

- Withdrawal Processing Speed: While fast, withdrawals may take up to one business day.

User Experience and App Usability

Account Setup and Onboarding Process

It’s pretty easy to start using this Versa app and get your investing journey kick-started. First, you have to download the app, provide their personal details and complete the e-KYC process by uploading identification and a selfie. There is a quick approval, and then customers can start investing right away. Pretty easy right?

Using The Versa App

The app’s dashboard provides a clear picture of your portfolio, recent transactions, and interest earned over time. Users can easily switch between different Versa products, deposit and withdraw funds, and access educational materials.

I personally had no difficulties in navigating through the screen to find what I want.

Customer Support and Educational Resources

The team at Versa provides responsive customer support in the form of in-app chat, phone, and video, along with an exhaustive FAQ page that they update from time to time. The website also provides educational articles and tutorials to guide users in making sound financial decisions. So, be sure to pay a visit and enhance your investment knowledge.

Personal Experience and Testimonials

Firsthand User Reviews

The majority of users all over the internet praise Versa for being easy to use, having competitive interest, and fast withdrawals. The daily interest feature is particularly a winner, as it has instant gratification and transparency.

Versa has changed my life when it comes to managing my extra fund. The daily interest and easy withdrawals make it so much better than a regular savings account. I also like that the interest is way higher than the traditional banks.

If there’s one takeaway from my Versa Malaysia review, it’s go give it a try! Use my referral code and get extra money into your funds when you deposit. It worked well for my by far and you’ll see the difference yourself.

Remember not to put all eggs in one basket.

Community Feedback and Reddit Insights

To gain more clarity, I always look online for more proof of its reliability. So I explored sites like Reddit and local financial communities, Versa is complimented as easy to use and reliable. There are small gripes about the delay in withdrawals at high volume times, but overall look and feel is good.

Comparison with Other Cash Management Platforms, A Versa Malaysia Review

Versa vs. KDI Save, StashAway Simple, and Others

Feature | Versa Cash | KDI Save | StashAway Simple | Touch ‘n Go GO+ |

Annualized Returns | 3.0% – 3.5% | 3.1% – 3.5% | 2.8% – 3.2% | 2.5% – 2.8% |

Min. Deposit | RM1 | RM100 | RM1 | RM10 |

Withdrawal Time | 1 business day | 1 business day | 1 business day | Instant |

Regulated by SC | Yes | Yes | Yes | Yes |

Unique Features | Daily interest | Auto-investing | Goal setting | E-wallet link |

Versa is also distinguished by its low minimum deposit amount, daily interest, and simple app experience. The KDI Save form of platform may be attractive to those seeking auto-investing features or cross-platform connectivity with other investment offerings.

Tips on Maximizing Versa Returns

Methods for Higher Returns

- Sustained Contributions: Set up automatic transfers to augment your balance and maximize compounding.

- Make the Most of Promotions: Capture additional returns from Versa’s campaigns and referral programs.

- Diversify Your Investments: Invest money in Versa Cash, Growth, and Retirement products for risk and reward diversification.

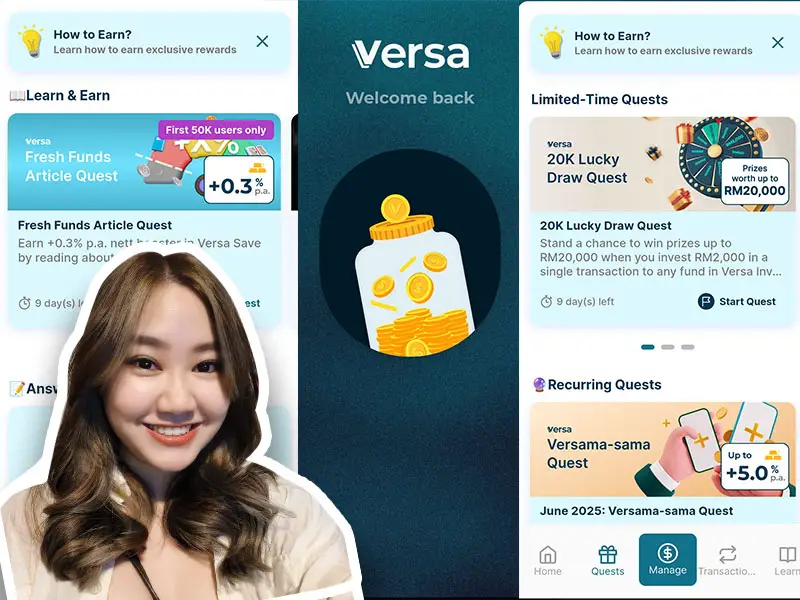

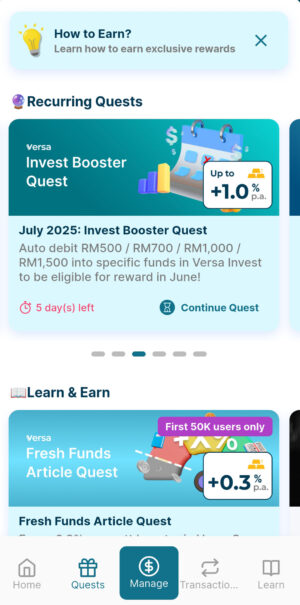

Making the Most of Auto-Debit, Quests and Promotions

Versa also comes with auto-debit feature where investment and savings can be automated. This “set and forget” enables regular contributions as well as harvesting market gains.

They also introduced an interesting concept, Quests which allow us to win prizes by maintaining a certain amount of balance and minimum investment amount. It’s a nice way to gamify investment by giving simple tasks and goals.

Is Versa Malaysia Legit and Safe?

Regulatory Status as well as SC Approval

Versa is regulated and licensed by the Securities Commission Malaysia, with high consumer protection and regulatory vigilance. Its funds are placed in trust by independent trustees who are removed from Versa operating accounts.

Security of Funds and Trust Structure

User funds are invested in money market funds which are regulated and overseen by experienced fund managers. The trust structure ensures that, in the very unlikely event of Versa insolvency, user funds remain safe and intact.

Frequently Asked Questions (FAQ)

Often Asked Versa Malaysia Questions

Q: Is Versa Shariah-compliant?

A: Versa Cash isn’t Shariah-compliant yet, though Versa is exploring Islamic investment products.

Q: How long does withdrawal take?

Q: How are withdrawals made?

A: Withdrawals are usually made within a business day.

Q: Are there guaranteed returns?

A: No, return is not guaranteed and will depend on market situations.

Q: Is there a lock-in period?

A: No, you can withdraw your money at any time without charges.

Is Versa Malaysia Worth It?

For Malaysians seeking a flexible, low-risk way to increase savings, Versa is an excellent choice. Its daily interest, low entry requirement, and user-friendly app make it accessible to anyone from students to professionals. Hope my Versa Malaysia review has covered all that you need to know to make a decision on this.

Who Can Use Versa Malaysia?

Versa is most appropriate for:

- Individuals seeking greater returns than a savings account.

- Those who need liquidity and flexibility.

- Those who want to build up an emergency fund or save for short-term goals.

- Anyone looking to invest who values convenience and simplicity.

Versa Malaysia has carved out a niche as a trusted, forward-thinking player in the local fintech scene. With its focus on accessibility, security, and competitive yields, Versa is a compelling choice for Malaysians who are eager to control their financial futures.

Is Versa legal in Malaysia

Yes, Versa is Malaysia law compliant! From what their website states, Versa is licensed and regulated by the Securities Commission Malaysia (SC), the central authority that oversees every capital market activity here in Malaysia. Beyond that, Versa partners with reputable financial institutions like AHAM Asset Management (also formerly known as Affin Hwang Asset Management) so you can be confident your money is in good hands.

What’s more important to know about Versa is that it adheres to all the rules and regulations laid down by the government on online investment sites. This just makes me feel better. It’s meant to make normal Malaysians like us budget our money better—essentially a savings account, but with the extra advantage of your money growing with money market funds. Apparently, it is also quite popular, particularly amongst young people who enjoy having a more intelligent way of handling money.

So go ahead and utilize Versa in Malaysia, knowing it’s completely legitimate, regulated, and safe place to put your money. If there’s any thoughts or opinions about my Versa Malaysia review, do comment below!

Disclaimer: The content in this post is for educational and information purposes only. It is not meant to be investment, tax, financial, or legal advice and should not be so considered. Always see a qualified professional with respect to any financial or investment decision.

Ready to Get Started?

Sign up for Versa today and join with the referral code WUZMTGGR. Make a minimum deposit of RM100, and you’ll receive an RM10 fund unit—one that will place funds in their pocket as well, since it will benefit the person who referred you! It’s a win-win situation all the way!

Valerie, Travel & Food Blogger

Valerie is a blogger in Malaysia living in the city of KL. She has a selective preference for beauty products ranging from skin care to makeup. Join her as she shares her insights as a beauty blogger!

Follow her @valerie.seow on Instagram.